2025 Tax Deadline: Extension Options & What You Need to Know

Editor’s Note: Information regarding the 2025 tax deadline and extension options is now available. This article provides crucial details to help you navigate the filing process.

Introduction:

The 2025 tax deadline looms, and with it, the familiar anxieties around filing taxes on time. But what happens if you need more time? This article explores the 2025 tax deadline, automatic extension options, and what you need to know to avoid penalties. We'll cover key aspects of tax extensions, interactive elements of the process, and advanced insights for navigating this crucial financial task.

Why This Topic Matters:

Understanding the 2025 tax deadline and available extension options is vital for every taxpayer. Missing the deadline can result in significant penalties and interest charges. This article provides clarity on the process, empowering you to file accurately and avoid potential financial repercussions. We'll cover key dates, eligibility requirements for extensions, and the steps to request an extension successfully.

Key Takeaways:

| Point | Explanation |

|---|---|

| 2025 Tax Deadline | [Insert Actual 2025 Tax Filing Deadline Date - April 15th (typically)] |

| Automatic Extension | Available; extends the filing deadline, not the payment deadline. |

| Extension Length | Typically six months (until October 15th). |

| Penalty Avoidance | Requesting an extension prevents penalties for late filing, but not for late payment. |

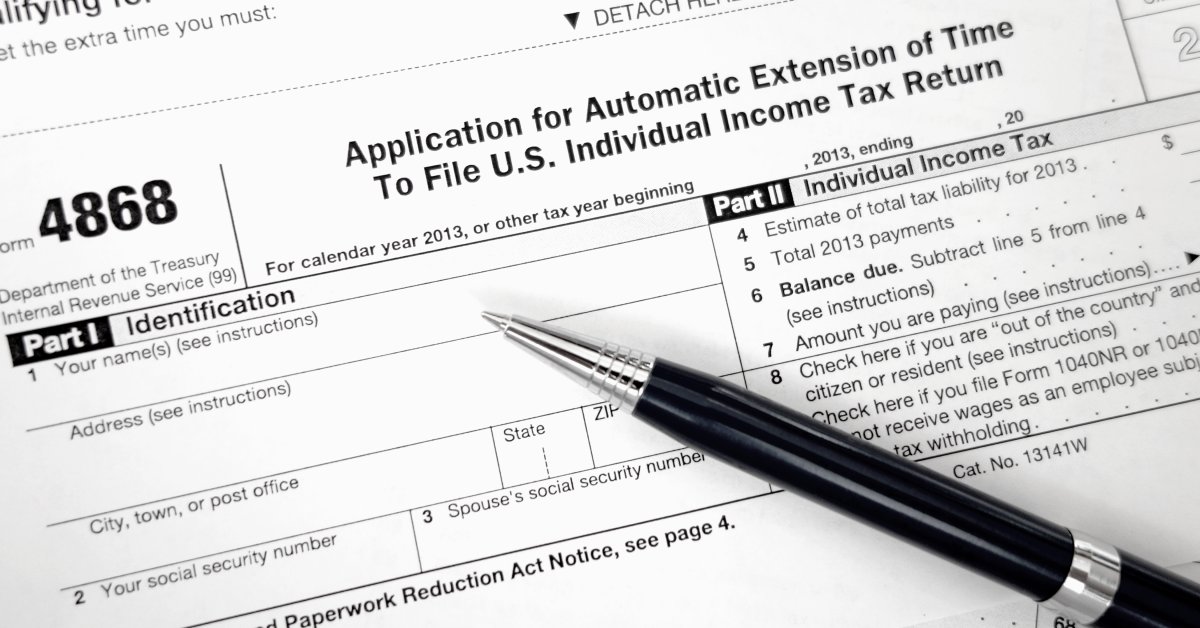

| Form to Use | Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return) |

1. 2025 Tax Deadline: Understanding the Basics

Introduction: The annual tax deadline signifies a crucial moment for millions of taxpayers. Failing to meet this deadline can lead to significant financial consequences.

Key Aspects: The 2025 tax deadline's key aspects include understanding the specific date, the difference between filing and payment deadlines, and the potential penalties for non-compliance.

Detailed Analysis: The standard deadline is typically April 15th. However, this date may shift if April 15th falls on a weekend or holiday. It's crucial to note that an extension applies only to filing your return, not to paying your taxes. You'll still need to estimate and pay your taxes by the original April 15th deadline to avoid penalties. Penalties for late filing can be substantial, depending on the amount owed and the length of the delay.

2. Interactive Elements on Tax Extensions

Introduction: Requesting a tax extension is largely an online process. Understanding the available tools and resources is critical for a smooth experience.

Facets: Key interactive elements include navigating the IRS website, accurately filling out Form 4868, and utilizing IRS online tools for tax payment. Potential challenges include website navigation difficulties and understanding the form's requirements.

Summary: The online process, while efficient, requires careful attention to detail. Double-checking the information provided before submission is crucial to avoid errors and delays.

3. Advanced Insights on Tax Extension Strategies

Introduction: Beyond the basic extension, strategic planning can help manage tax liabilities more effectively.

Further Analysis: This section could discuss strategies like estimated tax payments throughout the year to minimize the tax owed at the deadline, using tax software for accurate calculations, and consulting a tax professional for complex situations.

Closing: Proactive tax planning and understanding extension options are crucial components of responsible tax management.

People Also Ask (NLP-Friendly Answers):

Q1: What is the 2025 tax deadline? A: The 2025 tax deadline is typically April 15th, but this may vary depending on the calendar.

Q2: Why is requesting a tax extension important? A: Requesting an extension avoids penalties for late filing, giving you more time to gather necessary documents and accurately complete your return. However, remember that it doesn't extend the payment deadline.

Q3: How can a tax extension benefit me? A: It provides additional time to organize financial records, seek professional advice, and avoid late-filing penalties.

Q4: What are the main challenges with getting a tax extension? A: Potential challenges include accurately completing the necessary forms, understanding the implications of extending the filing deadline but not the payment deadline, and navigating the IRS website.

Q5: How to get started with requesting a tax extension? A: Begin by visiting the IRS website, downloading Form 4868, and completing it accurately. Submit the form by the original deadline (April 15th).

Practical Tips for 2025 Tax Filing:

Introduction: These actionable tips will help ensure a smoother tax filing process.

Tips:

- Gather all necessary tax documents well in advance.

- Use tax software or consult a tax professional for accurate calculations.

- File your return electronically for faster processing.

- Pay your estimated taxes on time to avoid penalties.

- Understand the implications of an automatic extension.

- Keep copies of all tax documents for your records.

- Check the IRS website for updates and announcements.

- Plan ahead for next year's tax season.

Summary: By following these tips, you can significantly reduce stress and potential complications during tax season.

Transition: Taking proactive steps now will ensure you are well-prepared for the 2025 tax deadline.

Summary: The 2025 tax deadline necessitates understanding extension options and utilizing available resources to avoid penalties. Proactive planning and careful attention to detail are key to a successful filing.

Call to Action: Ready to dive deeper? Visit the official IRS website for more detailed information on tax extensions and deadlines.