$27 Million Payday: Morgan Stanley's Gorman's Reward – CEO Compensation Sparks Debate

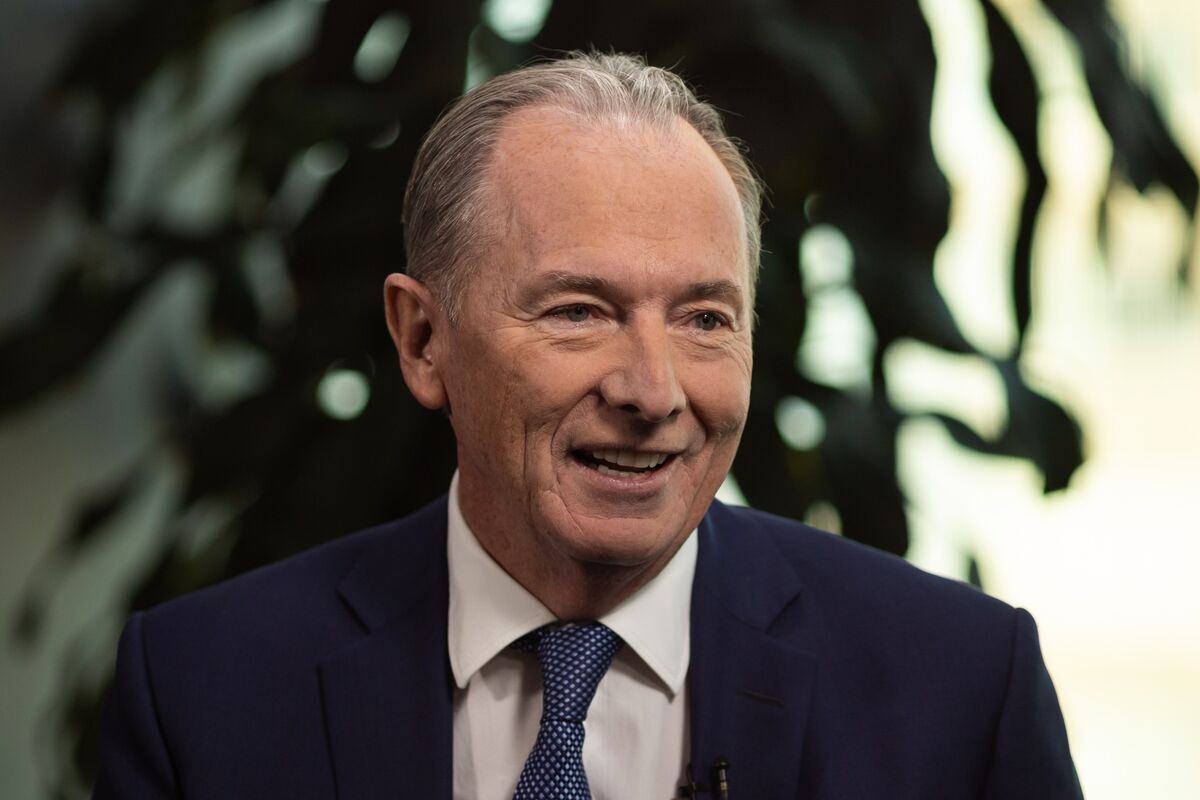

Editor’s Note: News broke today of Morgan Stanley CEO James Gorman's $27 million compensation package, sparking renewed discussion about executive pay in the financial sector.

Introduction: James Gorman, the Chairman and CEO of Morgan Stanley, received a staggering $27 million compensation package in 2022. This figure has ignited a firestorm of debate, raising questions about executive pay disparity and the performance metrics justifying such substantial rewards. This article delves into the details of Gorman's compensation, examines the rationale behind it, and explores the broader implications for the financial industry and public perception.

Why This Topic Matters: Executive compensation, particularly in the financial sector, is a consistently hot topic. Public scrutiny intensifies when payouts reach such significant levels, especially amidst economic uncertainty and growing income inequality. Understanding the factors contributing to these high figures is crucial for investors, employees, and policymakers alike. This article aims to provide a comprehensive analysis of Gorman's compensation, its justification, and the ongoing debate surrounding CEO pay.

Key Takeaways:

| Aspect | Summary |

|---|---|

| Compensation Breakdown | $27 million total, comprised of salary, bonus, and stock awards. |

| Performance Justification | Strong financial performance for Morgan Stanley in 2022 cited as rationale. |

| Public Perception | Significant public backlash and concerns about executive pay disparity. |

| Industry Trends | Reflects ongoing trends of high CEO compensation in the financial sector. |

| Future Implications | Potential for increased regulatory scrutiny and pressure for pay reforms. |

1. $27 Million Payday: Morgan Stanley's Gorman's Reward

Introduction: The $27 million compensation package awarded to James Gorman highlights the significant rewards at the top of the financial industry. While Morgan Stanley's performance in 2022 was undoubtedly strong, the sheer magnitude of this figure prompts critical examination.

Key Aspects: Gorman's compensation includes a base salary, a substantial performance-based bonus, and significant stock awards. The breakdown reflects the company's long-term incentive structure, designed to align executive interests with shareholder value.

Detailed Analysis: Morgan Stanley's 2022 financial results showed strong revenue growth and profitability across various divisions. The company's board of directors likely cited this performance as the primary justification for Gorman's substantial compensation. However, critics argue that this performance is partly attributable to broader market factors and doesn't fully justify the immense disparity between executive pay and the compensation of average employees.

2. Interactive Elements on CEO Compensation

Introduction: Understanding Gorman's compensation requires analyzing its different components and the interactive elements that contribute to its final figure.

Facets: The complex interplay of performance metrics, stock options, and long-term incentives influences the final payout. Risks include potential negative public perception and regulatory scrutiny, while rewards incentivize strong leadership and growth. Challenges include maintaining transparency and ensuring fair compensation across all levels of the organization.

Summary: The various facets of Gorman's compensation highlight the intricate and often opaque nature of executive pay structures in the financial industry. The debate centers on balancing the need to attract and retain top talent with concerns about fairness and societal impact.

3. Advanced Insights on Executive Compensation at Morgan Stanley

Introduction: A deeper dive into the intricacies of executive compensation at Morgan Stanley reveals complexities beyond a simple headline figure.

Further Analysis: Examining the compensation structures of other senior executives at Morgan Stanley provides a broader context. Comparing Gorman's package to those of CEOs at competing firms sheds light on industry benchmarks and prevailing trends. Expert opinions on corporate governance and executive compensation offer valuable insights into the ongoing debate.

Closing: Understanding the nuanced aspects of executive pay requires considering various factors beyond simple performance metrics. The debate is likely to continue as public and regulatory scrutiny of CEO compensation intensifies.

People Also Ask (NLP-Friendly Answers):

Q1: What is James Gorman's compensation? A: James Gorman's 2022 compensation package totaled $27 million, comprising salary, bonus, and stock awards.

Q2: Why is Gorman's compensation so high? A: Morgan Stanley's strong financial performance in 2022 is cited as the primary justification. However, the magnitude of the payout has drawn criticism regarding pay disparity.

Q3: How does Gorman's pay compare to other CEOs? A: A comparison with CEOs of similar-sized financial institutions is needed to establish a benchmark, and this varies year to year.

Q4: What are the challenges with such high CEO pay? A: High CEO pay contributes to income inequality and can fuel public distrust in the financial industry, leading to increased regulatory scrutiny.

Q5: What are the implications of this situation? A: This situation could lead to further debate on executive compensation, potential regulatory changes, and increased pressure on companies to be more transparent about pay structures.

Practical Tips for Understanding Executive Compensation:

Introduction: Understanding executive compensation can seem daunting, but these tips will help you navigate the complexities.

Tips:

- Examine the full compensation package, not just the headline figure.

- Compare CEO pay to company performance and industry benchmarks.

- Consider the long-term incentive structures in place.

- Pay attention to shareholder voting on executive compensation.

- Research the company's corporate governance policies.

- Follow news and analysis of executive pay trends.

- Advocate for greater transparency in executive compensation.

- Support policies that promote fairer pay structures.

Summary: These practical tips enable informed engagement with the ongoing debate about executive compensation.

Transition: The debate over executive pay is far from over; increased transparency and accountability are crucial for fostering trust and ensuring fairness.

Summary: James Gorman's $27 million compensation package serves as a focal point for the ongoing discussion surrounding executive pay in the financial sector. While strong performance justifies significant rewards, the magnitude of the payout raises questions about fairness, transparency, and the wider societal implications of such vast income disparities.

Call to Action: Ready to dive deeper? Subscribe for more insights on executive compensation and corporate governance.