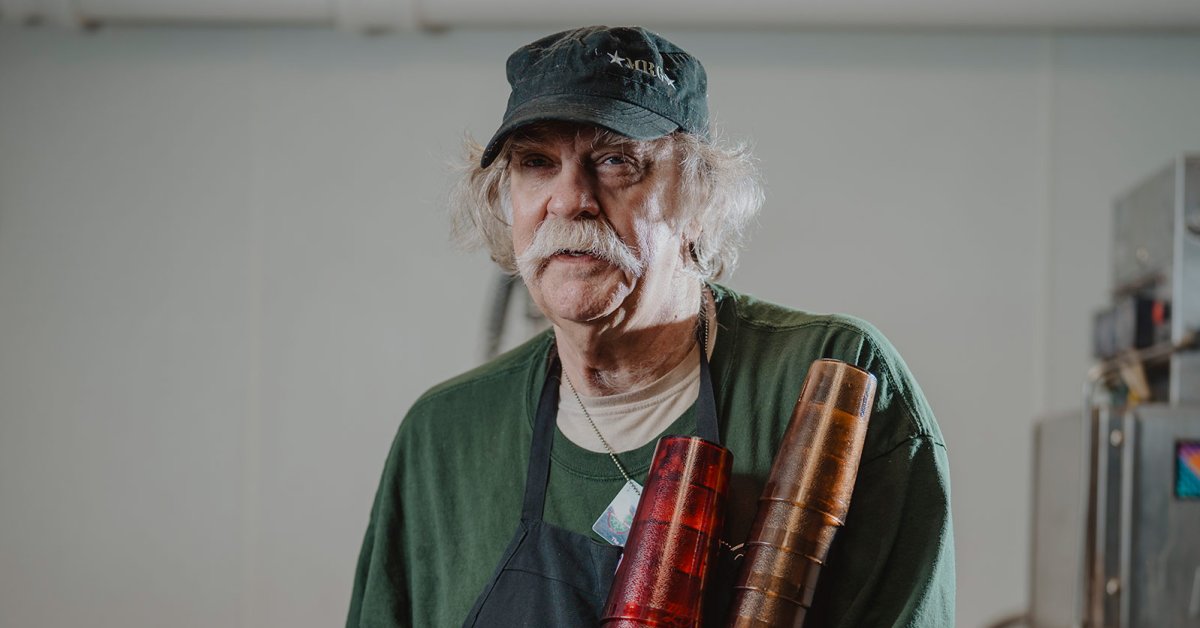

America's Aging Workforce: Retirement's Grim Reality

Editor's Note: Concerns about America's aging workforce and the challenges of retirement are escalating. This article explores the key issues and potential solutions.

1. Why This Topic Matters

America is facing a demographic time bomb. The baby boomer generation is entering retirement, leaving a significant gap in the workforce and highlighting a stark reality: many are unprepared for the financial realities of retirement. This isn't just an individual problem; it's a societal one impacting economic growth, healthcare systems, and social security. This article will delve into the key aspects of this crisis, examining the factors contributing to the problem and exploring potential solutions. We'll cover issues like insufficient savings, rising healthcare costs, and the evolving nature of work in the 21st century.

2. Key Takeaways

| Challenge | Impact | Solution |

|---|---|---|

| Insufficient Retirement Savings | Financial insecurity in retirement | Increased retirement planning & savings |

| Rising Healthcare Costs | Strain on personal finances & Medicare | Healthcare reform & preventative measures |

| Longevity | Increased retirement expenses | Adapting to longer lifespans & financial planning |

| Shifting Employment Landscape | Job insecurity & lack of retirement benefits | Workforce retraining & alternative income streams |

3. Main Content

3.1 America's Aging Workforce: A Looming Crisis

The American workforce is aging rapidly. Millions of baby boomers are reaching retirement age, and the percentage of older workers is steadily increasing. This demographic shift presents both opportunities and significant challenges. While older workers bring valuable experience and skills, the reality is many lack the financial resources to comfortably retire. Decades of stagnant wage growth, increased healthcare costs, and the rise of the gig economy have contributed to a retirement savings crisis.

Key Aspects:

- Insufficient Savings: A significant portion of Americans lack adequate savings for retirement, relying heavily on Social Security which may not be sufficient for their needs.

- Rising Healthcare Costs: Healthcare expenses represent a major burden for retirees, often exceeding other retirement costs.

- Increased Longevity: People are living longer, requiring larger retirement nest eggs to cover their expenses for an extended period.

Detailed Analysis: The lack of sufficient retirement savings stems from various factors, including low wages, limited access to retirement plans (especially for gig workers), and a lack of financial literacy. Rising healthcare costs, driven by inflation and advancements in medical technology, exacerbate the problem. Finally, increased longevity, while positive, adds to the financial strain of retirement. Without significant changes, the financial burden on individuals, families, and the social security system will continue to grow.

3.2 Interactive Elements of Retirement Planning

Interactive tools and resources play a crucial role in helping individuals prepare for retirement.

Facets:

- Retirement Calculators: Online tools help individuals estimate their retirement needs based on their current savings, expenses, and expected income.

- Financial Planning Websites & Apps: These platforms offer personalized advice, investment options, and educational resources.

- Government Resources: The Social Security Administration and other government agencies provide valuable information and resources for retirement planning.

Summary: Utilizing these interactive tools empowers individuals to take control of their financial future and prepare for a more secure retirement.

3.3 Advanced Insights on Retirement Security

Understanding the complexities of retirement requires a deeper dive into the potential solutions.

Further Analysis: Policymakers are exploring various solutions to address the retirement crisis, including increasing Social Security benefits, expanding access to retirement savings plans, and promoting financial literacy. Furthermore, innovations in healthcare delivery and preventative care could help manage the rising costs of healthcare in retirement.

Closing: Addressing America's aging workforce and retirement challenges demands a multi-faceted approach involving individual responsibility, employer initiatives, and government policies.

4. People Also Ask (NLP-Friendly Answers)

Q1: What is the retirement crisis in America? A: The retirement crisis refers to the growing number of Americans lacking sufficient savings to maintain their lifestyle in retirement, due to factors like low wages, high healthcare costs, and inadequate retirement plans.

Q2: Why is retirement planning important? A: Retirement planning ensures financial security and independence during your later years, reducing reliance on government assistance and allowing you to enjoy your retirement without financial stress.

Q3: How can I improve my retirement savings? A: Contribute regularly to retirement accounts (401(k), IRA), reduce debt, increase savings, and seek professional financial advice.

Q4: What are the challenges of retirement? A: Challenges include insufficient savings, rising healthcare costs, unexpected expenses, and adapting to a different lifestyle.

Q5: How can I get started with retirement planning? A: Begin by assessing your current financial situation, setting realistic goals, and exploring available retirement planning resources and tools.

5. Practical Tips for Retirement Planning

Introduction: Taking proactive steps now can significantly improve your retirement security.

Tips:

- Start Saving Early: The earlier you begin saving, the more time your money has to grow.

- Maximize Retirement Contributions: Contribute the maximum amount allowed to your employer-sponsored retirement plan.

- Diversify Investments: Spread your investments across different asset classes to reduce risk.

- Pay Down High-Interest Debt: High-interest debt can significantly eat into your retirement savings.

- Create a Retirement Budget: Estimate your expenses in retirement and adjust your savings plan accordingly.

- Plan for Healthcare Costs: Factor in potential healthcare expenses, including long-term care.

- Stay Informed: Continuously educate yourself about retirement planning and investment strategies.

- Seek Professional Advice: Consult a financial advisor to create a personalized retirement plan.

Summary: These practical tips can help you navigate the complexities of retirement planning and secure a more comfortable future.

Transition: While the challenges are significant, proactive planning and informed decision-making can pave the way for a more secure retirement.

6. Summary

America's aging workforce and the ensuing retirement crisis demand immediate attention. Insufficient savings, rising healthcare costs, and increased longevity pose significant challenges. However, through proactive planning, utilization of available resources, and policy changes, individuals and society can work towards a more secure retirement for all.

7. Call to Action (CTA)

Ready to secure your financial future? Start planning for retirement today! Explore our resources and learn more about maximizing your savings.