Extend Your 2025 Taxes: Simple Steps to Avoid Penalties

Editor’s Note: The deadline for filing your 2025 taxes is fast approaching. Don't miss out on this crucial information!

Introduction:

Facing a tax deadline and feeling overwhelmed? You're not alone. Many taxpayers find themselves needing extra time to gather their documents and complete their returns accurately. This article provides simple steps to successfully extend your 2025 tax deadline and avoid penalties. We’ll cover the process, the reasons why you might need an extension, and what to expect after filing for an extension.

Why This Topic Matters:

Filing taxes can be complex, and missing the deadline can result in significant penalties. Understanding how to request an extension is crucial for responsible tax management. This timely guide empowers taxpayers to navigate the extension process confidently, ensuring compliance and avoiding financial repercussions. We’ll break down the process step-by-step, making it easy to understand, even for those unfamiliar with tax regulations. Key points covered include eligibility, the application process, and post-extension responsibilities.

Key Takeaways:

| Benefit | Description |

|---|---|

| Avoid Penalties | Extension prevents late-filing penalties. |

| More Time to Organize | Provides additional time to gather necessary documents and complete your return. |

| Peace of Mind | Reduces stress and anxiety associated with looming deadlines. |

| Simple Application Process | Easy-to-follow steps for submitting your extension request. |

1. Extend Your 2025 Taxes

Introduction: Requesting a tax extension isn't an excuse to avoid filing; it's a tool for responsible taxpayers who need more time. This process is designed to be straightforward, preventing unnecessary penalties.

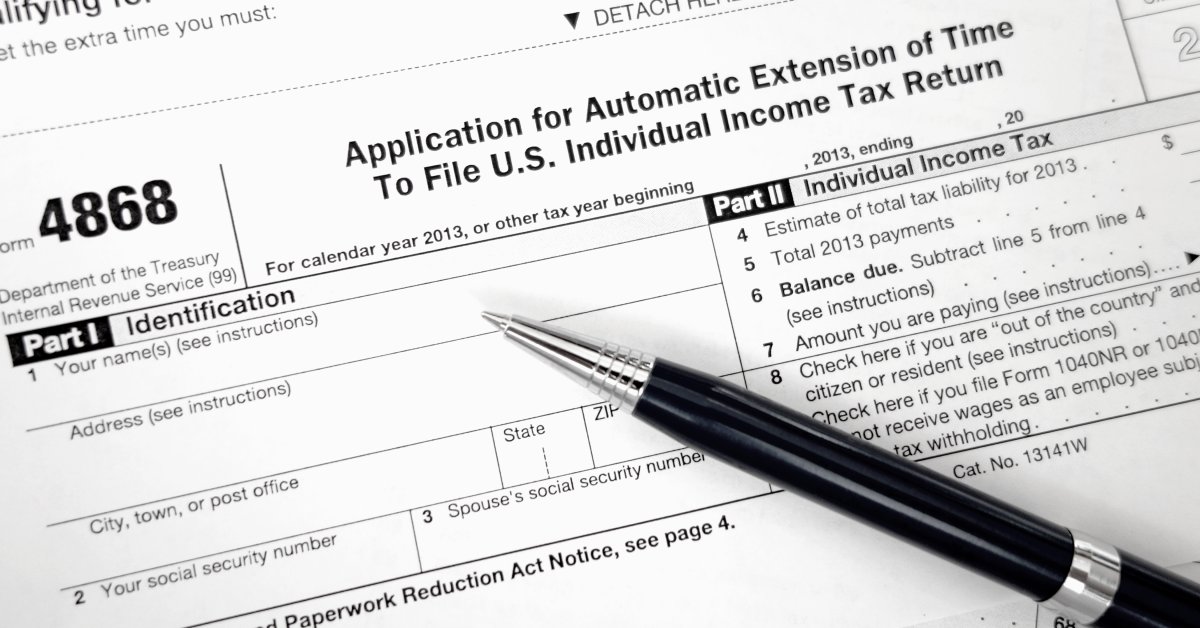

Key Aspects: The primary aspect is submitting Form 4868 (Application for Automatic Extension of Time To File U.S. Individual Income Tax Return) before the original tax deadline. This form doesn't require detailed financial information; it simply requests an extension of time to file.

Detailed Analysis: The IRS grants automatic extensions for six months. This means instead of filing by April 15th, 2026 (assuming no changes to the standard tax deadline), you would have until October 15th, 2026. However, remember that while the filing deadline is extended, the payment deadline is not. You're still obligated to pay your estimated taxes by the original deadline. Failing to pay on time will still incur penalties and interest.

2. Interactive Elements on Tax Extensions

Introduction: The IRS offers online tools and resources to simplify the extension process.

Facets: The IRS website provides a downloadable Form 4868, instructions for completing it accurately, and FAQs addressing common concerns. The online filing system also facilitates easy submission. Potential challenges include navigating the website, ensuring accurate information, and understanding the nuances of estimated tax payments.

Summary: Utilizing the IRS's online resources streamlines the extension process and mitigates the risk of errors. Understanding the limitations – specifically, the payment deadline – is crucial to avoid additional penalties.

3. Advanced Insights on Tax Extensions

Introduction: For complex tax situations, seeking professional guidance can be invaluable.

Further Analysis: Tax professionals can help navigate intricate financial situations, ensuring accurate tax calculations and efficient filing. They can also provide advice on minimizing your tax liability and strategizing for future tax years. For self-employed individuals or those with complex income streams, professional assistance is highly recommended.

Closing: While the extension process is straightforward, seeking professional help ensures compliance and optimizes your tax strategy. Understanding your individual circumstances and seeking expert advice when needed is key to responsible tax management.

People Also Ask (NLP-Friendly Answers):

Q1: What is a tax extension? A: A tax extension is an extra amount of time granted by the IRS to file your tax return.

Q2: Why is a tax extension important? A: It prevents late-filing penalties and gives you more time to gather necessary financial information for accurate filing.

Q3: How can a tax extension benefit me? A: It allows for more time to organize your tax documents, reducing stress and the risk of errors.

Q4: What are the main challenges with requesting a tax extension? A: The main challenge is remembering to pay your estimated taxes by the original deadline, even if your filing deadline is extended.

Q5: How to get started with requesting a tax extension? A: Download Form 4868 from the IRS website, complete it accurately, and submit it before the tax filing deadline.

Practical Tips for Extending Your Taxes:

Introduction: Here are some practical steps to ensure a smooth extension process.

Tips:

- Gather all necessary tax documents well in advance.

- Download Form 4868 from the IRS website.

- Complete the form accurately, double-checking all information.

- File the form before the original tax deadline.

- Pay your estimated taxes by the original tax deadline to avoid penalties.

- Keep a copy of your filed Form 4868 for your records.

- Consider seeking professional help if you have a complex tax situation.

- Mark your calendar with the new filing deadline (October 15th, 2026).

Summary: Extending your tax deadline is a simple process that can alleviate stress and prevent penalties. By following these steps and understanding the implications, you can confidently manage your tax obligations.

Call to Action: Ready to simplify your tax process? Download Form 4868 today and ensure a stress-free tax season!

(Remember to replace placeholder dates with the actual 2025 tax deadlines.)