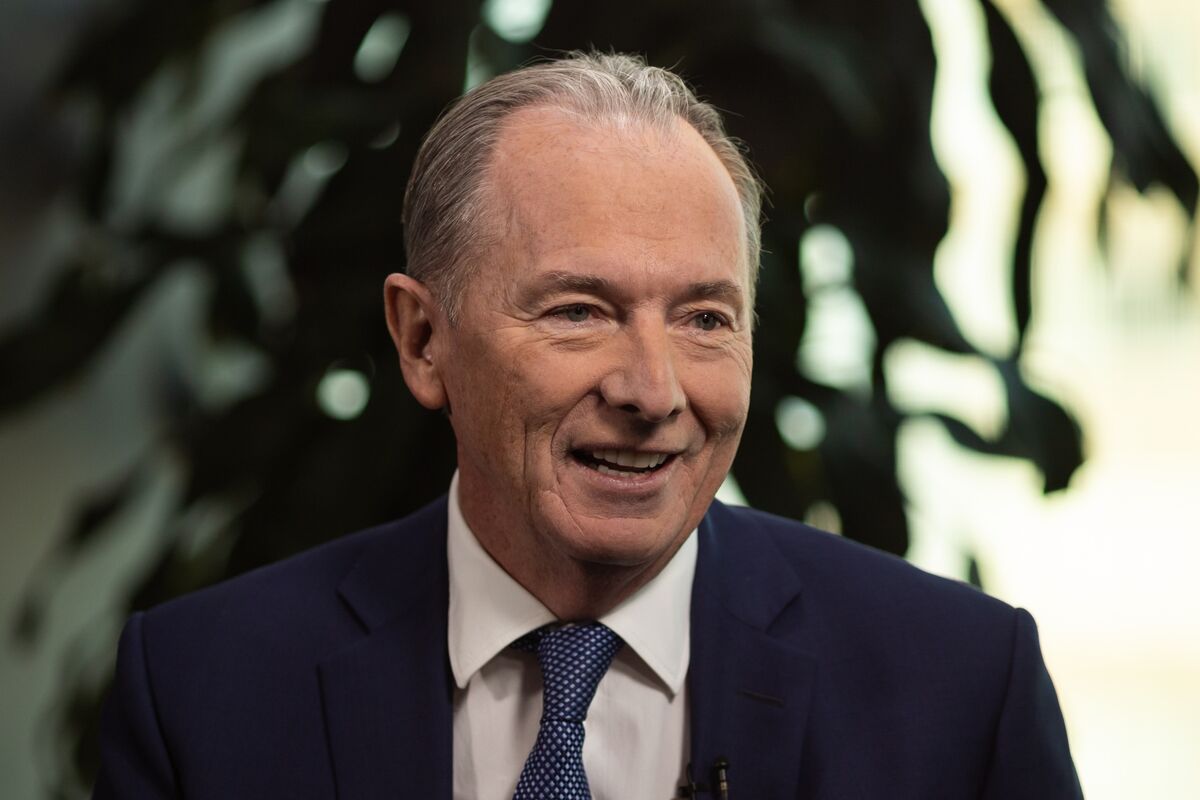

Morgan Stanley CEO Gorman's $27M Pay Package Sparks Debate

Editor’s Note: News of Morgan Stanley Chairman and CEO James Gorman's $27 million compensation package for 2022 has been released today, sparking widespread discussion.

This article delves into the details of Gorman's compensation, analyzes its components, and explores the broader context of executive pay in the financial industry. We’ll examine the justification for such a significant payout, considering Morgan Stanley's performance and the ongoing debate surrounding executive compensation in the current economic climate.

Why This Topic Matters

James Gorman's substantial compensation package serves as a potent symbol of the ongoing discussion surrounding executive pay in the financial sector. His earnings reflect the significant rewards reaped by top executives at leading financial institutions, even amidst economic uncertainty and rising public concern over income inequality. Understanding the factors contributing to this figure – including performance-based bonuses, stock awards, and other benefits – is crucial for investors, employees, and the public to assess the fairness and efficacy of executive compensation structures. This article will explore the key components of Gorman's pay and analyze their implications for Morgan Stanley's future, as well as the broader financial landscape. We'll examine the role of shareholder activism, regulatory pressures, and public perception in shaping the future of executive compensation.

| Key Takeaways | |---|---| | Record High: Gorman's $27 million compensation represents a significant increase compared to previous years. | | Performance-Based: A substantial portion of the compensation is tied to Morgan Stanley's strong financial performance in 2022. | | Controversy: The package has sparked debate regarding executive pay disparity and its impact on societal equity. | | Future Implications: This compensation package sets a precedent for other financial institutions and may influence future regulatory discussions. |

Morgan Stanley CEO James Gorman's $27 Million Compensation Package: A Detailed Look

Introduction: The disclosure of James Gorman's $27 million compensation package for 2022 has ignited a renewed conversation surrounding the compensation of top executives in the financial industry. This significant figure raises important questions about the relationship between executive pay, corporate performance, and societal equity.

Key Aspects: Gorman's compensation consists of a base salary, substantial stock awards, performance-based bonuses, and other benefits. The precise breakdown of these elements remains subject to further analysis, with the details being presented in Morgan Stanley's official filings.

Detailed Analysis: While the specifics require closer examination of financial reports, it's likely that Morgan Stanley's strong performance in 2022 played a major role in determining the size of Gorman's compensation. This performance, measured through key metrics such as revenue growth, profitability, and market share, would likely justify a significant portion of the performance-based compensation. However, the magnitude of the reward compared to average employee compensation at Morgan Stanley is likely to remain a focal point of criticism.

Interactive Elements on CEO Compensation at Morgan Stanley

Introduction: The public nature of this compensation disclosure and the subsequent media attention it has generated create a dynamic, interactive landscape.

Facets: The discussion is influenced by several key facets: Shareholder reactions (including potential shareholder proposals concerning executive compensation), regulatory scrutiny (given the focus on fair compensation practices), and public opinion (influenced by perceptions of wealth inequality). The potential impact of negative public sentiment on Morgan Stanley's brand reputation is also a significant element.

Summary: The interactive elements highlight the complex interplay of financial performance, public perception, and regulatory oversight in shaping executive compensation. These factors will undoubtedly continue to shape debates surrounding CEO pay in the future.

Advanced Insights on CEO Compensation Trends

Introduction: Understanding the trends in CEO compensation requires analyzing factors beyond individual payouts. This section delves into broader macroeconomic and industry-specific influences that shape executive compensation practices.

Further Analysis: Executive compensation in the financial sector is influenced by factors such as market competition for talent, the cyclical nature of the financial industry, and the perceived risk associated with leading large financial institutions. Comparative analysis with CEO compensation at peer institutions (e.g., Goldman Sachs, JPMorgan Chase) helps provide context and identify trends. Expert opinions from compensation consultants and financial analysts further enrich the discussion.

Closing: The future of executive compensation in the financial industry hinges on a complex interplay of market forces, regulatory frameworks, and public opinion. The transparency surrounding compensation practices will play a crucial role in shaping future discussions and potentially influencing legislative actions.

People Also Ask (NLP-Friendly Answers)

Q1: What is James Gorman's compensation package? A: James Gorman's 2022 compensation package totaled $27 million, comprising a base salary, stock awards, performance-based bonuses, and other benefits. The exact breakdown awaits further analysis of Morgan Stanley's official disclosures.

Q2: Why is this compensation package important? A: This package highlights the ongoing debate about executive pay in the financial sector, particularly concerning its relationship to corporate performance, shareholder value, and social equity. It serves as a benchmark for future discussions and potentially influences regulatory changes.

Q3: How can this impact Morgan Stanley's reputation? A: Public perception of excessive executive pay can negatively impact a company's brand image, potentially affecting investor confidence, employee morale, and customer loyalty. Morgan Stanley's response to the criticism will be crucial in managing its reputation.

Q4: What are the main challenges with high executive compensation? A: Challenges include potential conflicts of interest, the perception of unfair wealth distribution, and the impact on company culture and employee morale. It can also draw regulatory scrutiny and shareholder activism.

Q5: What's the future of CEO compensation at Morgan Stanley? A: The future of CEO compensation will likely involve a careful balancing act between rewarding strong performance, addressing public concerns regarding fairness and equity, and adhering to evolving regulatory frameworks.

Practical Tips for Understanding Executive Compensation

Introduction: Understanding executive compensation requires a multifaceted approach.

Tips:

- Analyze Financial Statements: Scrutinize the compensation disclosure sections of company filings (10-K, proxy statements).

- Compare to Peers: Benchmark executive pay against competitors in the same industry.

- Examine Performance Metrics: Correlate executive compensation with the company's overall financial performance and key performance indicators (KPIs).

- Consider Shareholder Activism: Track shareholder proposals and resolutions related to executive compensation.

- Follow Regulatory Developments: Stay informed about changes in regulations affecting executive pay.

- Read Expert Analyses: Consult reports and analyses from compensation consultants and financial analysts.

- Assess Public Opinion: Monitor media coverage and public reaction to executive compensation announcements.

- Consider the Long-Term Perspective: Evaluate the sustainability and long-term impact of compensation structures.

Summary: By actively engaging with these tips, individuals can develop a more nuanced understanding of the complexities of executive compensation.

Transition: These insights provide a crucial foundation for informed discussions about the crucial role of executive compensation in shaping the financial landscape.

Summary

James Gorman's $27 million compensation package raises critical questions about executive pay in the financial industry. Analyzing this package requires examining its components, comparing it to industry norms, and considering its implications for Morgan Stanley's reputation and broader societal issues. Public scrutiny and regulatory responses will shape the future of executive compensation practices.

Call to Action

Ready to dive deeper? Subscribe for more insights on executive compensation trends in the financial sector!