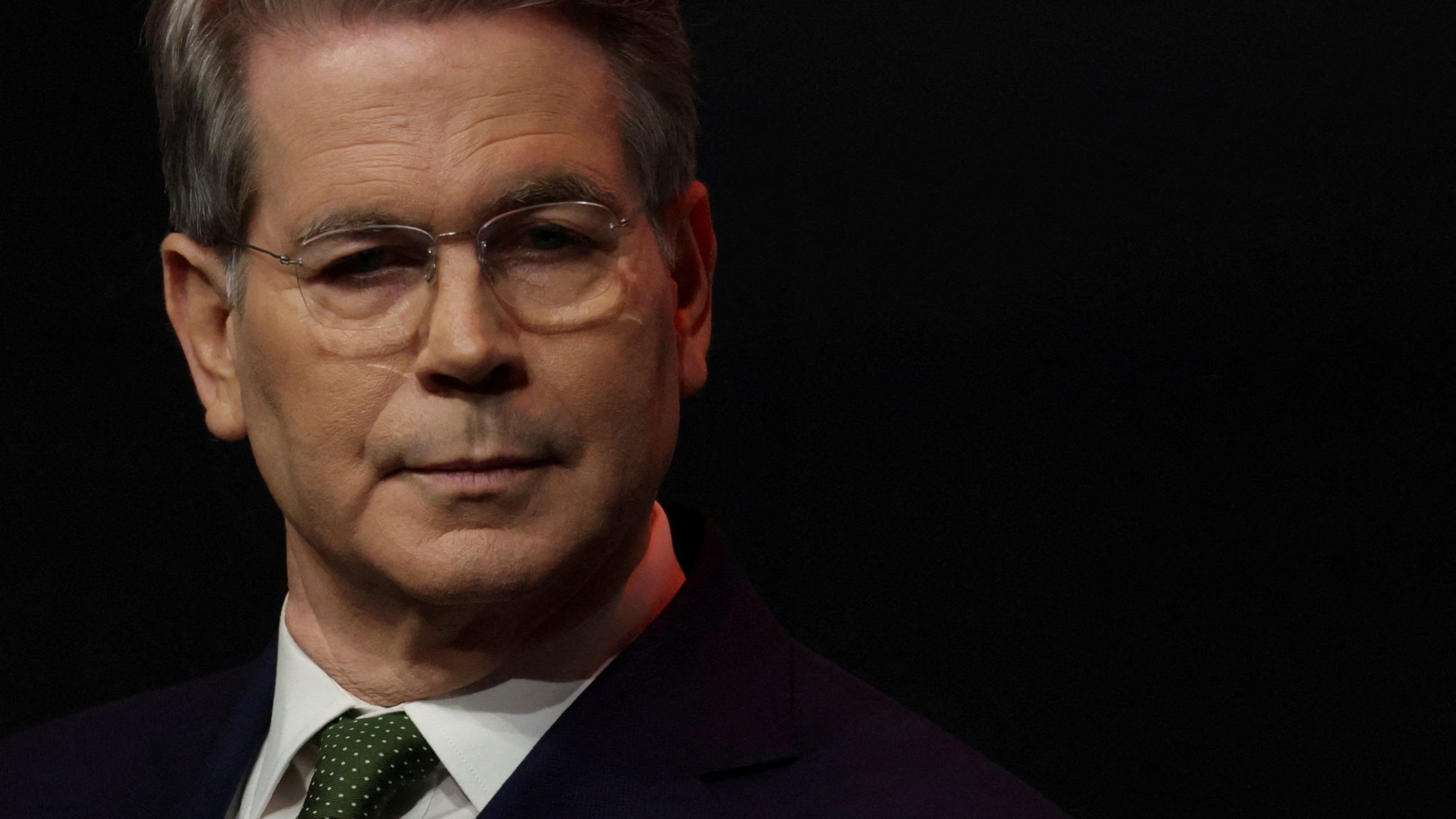

Mnuchin: Tariffs Won't Trigger Recession – A Deep Dive into the Claim

Editor's Note: Steven Mnuchin's recent statement claiming tariffs won't cause a recession has sparked intense debate. This article analyzes his assertion, exploring supporting arguments, counterpoints, and the broader economic implications.

1. Why This Matters:

The ongoing trade war and the potential for a US recession are paramount concerns for businesses, investors, and consumers worldwide. Mnuchin's statement, made [Insert Date and Source of Statement], directly addresses these anxieties. Understanding the reasoning behind his claim, the economic data supporting (or refuting) it, and the potential consequences is crucial for navigating the current economic climate. This article will dissect the key arguments, exploring the complexities of the tariff debate and examining potential future scenarios. Keywords analyzed include: tariffs, recession, Mnuchin, trade war, economic impact, US economy, GDP growth.

2. Key Takeaways:

| Point | Supporting Evidence | Counterarguments |

|---|---|---|

| Strong US Economy | Robust job growth, low unemployment rates | Rising inflation, potential for supply chain disruptions |

| Tariff Impact Mitigation | Government actions to offset negative effects | Limited effectiveness of such measures, delayed impact |

| Negotiated Trade Deals | Potential for future agreements to reduce trade tensions | Uncertainty surrounding negotiations, potential setbacks |

| Global Economic Factors | Influence of global growth on US economic performance | Vulnerability to global economic slowdown |

3. Main Content

3.1 Mnuchin's Claim: Tariffs and the Recession Risk

Mnuchin's assertion that tariffs will not trigger a recession rests on several pillars. He points to the current strength of the US economy, citing [Insert specific economic indicators cited by Mnuchin, e.g., strong GDP growth, low unemployment]. Furthermore, he likely highlights the administration's efforts to mitigate the negative impacts of tariffs through [Insert specific examples, e.g., farm subsidies, targeted tax relief]. The underlying argument is that the US economy is resilient enough to absorb the short-term pain of tariffs while benefiting from long-term gains through renegotiated trade deals.

Key Aspects: The core of Mnuchin's argument centers on the belief that the benefits of tariffs (e.g., protecting domestic industries, leveraging bargaining power) outweigh the costs (e.g., increased prices for consumers, potential for retaliatory tariffs).

Detailed Analysis: However, this optimistic view is countered by numerous economists who highlight the potential for significant negative consequences. Rising inflation, supply chain disruptions due to retaliatory tariffs, and reduced consumer spending are all potential downsides. The impact of tariffs on specific sectors, like agriculture and manufacturing, needs careful consideration, analyzing the extent to which government support can truly offset negative effects.

3.2 Interactive Elements on the Tariff Debate

The impact of tariffs is not a static issue; it’s a dynamic interplay of various economic factors. Interactive elements, such as online economic models and simulations, could provide further insight into the potential consequences of different tariff scenarios. These models would allow users to input various assumptions (e.g., the magnitude of tariffs, the responsiveness of businesses and consumers) and see their impact on key economic variables (e.g., GDP growth, inflation, unemployment).

Facets: The key facets to consider in interactive models include the elasticity of demand and supply for affected goods, the degree of retaliation by other countries, and the effectiveness of government mitigation strategies.

Summary: Interactive tools could provide a crucial level of transparency and understanding, enabling a more informed discussion about the economic consequences of tariffs.

3.3 Advanced Insights on the Economic Outlook

The impact of tariffs cannot be viewed in isolation. Global economic conditions, including growth in China and Europe, significantly influence the US economy. A global slowdown could amplify the negative impacts of tariffs, potentially pushing the US into a recession. Conversely, robust global growth could mitigate some of the negative effects.

Further Analysis: Expert opinions on the interplay between global economic factors and tariff impacts vary widely. Some economists argue that the resilience of the US economy can withstand the current trade tensions, while others express significant concerns about the potential for a recession. The ongoing uncertainty surrounding trade negotiations further complicates the economic outlook.

Closing: A comprehensive analysis requires considering both domestic and international economic factors, acknowledging the inherent complexities and uncertainties involved in predicting the future.

4. People Also Ask (NLP-Friendly Answers)

Q1: What is Mnuchin's stance on tariffs and recession? A: Mnuchin believes that current tariffs will not cause a US recession, citing the strength of the US economy and government efforts to mitigate negative impacts.

Q2: Why is Mnuchin's claim controversial? A: Many economists disagree, arguing that tariffs could lead to inflation, supply chain disruptions, and reduced consumer spending, potentially triggering a recession.

Q3: How could tariffs benefit the US economy? A: Proponents argue that tariffs protect domestic industries and provide leverage in trade negotiations, leading to better long-term trade deals.

Q4: What are the main risks associated with tariffs? A: Retaliatory tariffs, increased prices for consumers, supply chain disruptions, and decreased global trade are major risks.

Q5: How can I learn more about the economic impact of tariffs? A: Research reputable economic sources, including government reports, academic studies, and analyses from financial institutions.

5. Practical Tips for Understanding the Tariff Debate

Introduction: Staying informed about economic developments is crucial for making sound financial decisions.

Tips:

- Follow reputable news sources for updates on economic indicators.

- Read analysis from economists with diverse viewpoints.

- Understand the difference between short-term and long-term economic impacts.

- Analyze the impact of tariffs on specific industries.

- Consider the role of government policies in mitigating negative effects.

- Stay updated on international trade negotiations.

- Monitor global economic indicators for potential spillover effects.

- Consult a financial advisor for personalized guidance.

Summary: By actively seeking out diverse perspectives and analyzing economic data, you can better understand the complex implications of the tariff debate and its potential impact on your financial well-being.

Transition: The ongoing debate over tariffs and their potential impact on the US economy highlights the importance of informed decision-making.

6. Summary:

Steven Mnuchin's claim that tariffs won't trigger a recession is a significant assertion within the ongoing trade war debate. While the current strength of the US economy offers some support, counterarguments highlight potential risks such as inflation and supply chain disruptions. A comprehensive understanding requires analyzing various economic indicators, considering global economic factors, and acknowledging the inherent uncertainties involved in economic forecasting.

7. Call to Action:

Ready to dive deeper? Subscribe for more in-depth analysis of the US economy and the ongoing trade war.