Retirement's Distant Dream: Why Aging American Workers Face a Crisis

Editor's Note: The plight of aging American workers facing retirement insecurity is a growing concern. This article explores the challenges and potential solutions.

1. Introduction:

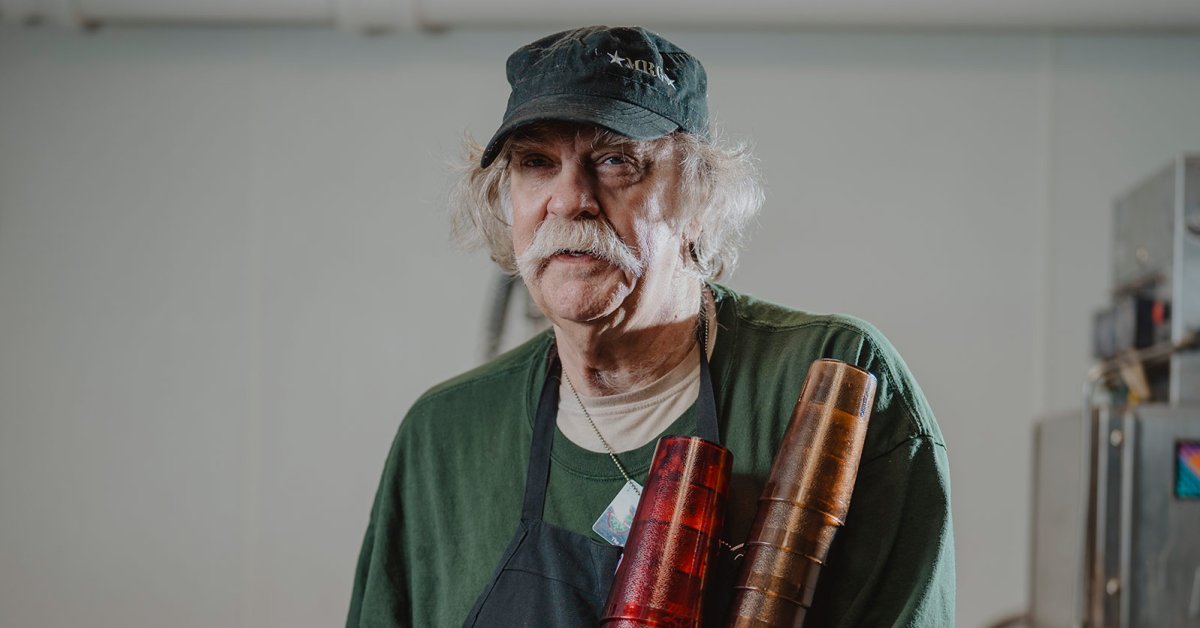

The American Dream often includes a comfortable retirement, but for millions of aging workers, that dream is fading fast. This isn't just about saving enough; it's a complex issue woven with rising healthcare costs, stagnant wages, and shifting economic landscapes. This article delves into the struggles faced by older American workers and explores the potential solutions needed to secure their financial futures.

2. Why This Topic Matters:

The aging workforce is a ticking time bomb. With the baby boomer generation entering retirement and life expectancy increasing, the strain on social security and individual retirement accounts is immense. This isn't just a personal financial crisis; it's a societal issue with far-reaching consequences. Understanding the challenges faced by older workers is crucial for policymakers, employers, and individuals alike to implement effective strategies. This article will explore: the widening retirement savings gap, the impact of inflation on retirement planning, and the increasing burden of healthcare costs in later life.

3. Key Takeaways:

| Challenge | Impact | Potential Solution |

|---|---|---|

| Insufficient Retirement Savings | Financial insecurity in retirement | Increased employer-sponsored plans, improved financial literacy programs |

| Rising Healthcare Costs | Dramatically reduces retirement income | Healthcare reform, affordable insurance options |

| Stagnant Wages | Limits savings accumulation | Increased minimum wage, stronger labor protections |

| Longevity | Requires larger retirement nest eggs | Adjusting retirement planning timelines, exploring alternative income streams |

4. Main Content

Subheading 1: Aging American Workers: A Looming Crisis

Introduction: The reality is stark: many older Americans are facing a retirement significantly less comfortable than anticipated. Decades of economic shifts, including wage stagnation and the increasing cost of living, have left many without adequate savings.

Key Aspects: The core issues include insufficient retirement savings, mounting healthcare expenses, and a lack of accessible, affordable long-term care options. These factors combine to create a perfect storm for financial insecurity in old age.

Detailed Analysis: Data reveals a significant percentage of older Americans relying heavily on Social Security, which may not be enough to cover their expenses. The rising cost of healthcare, often exceeding the cost of housing, further exacerbates the problem. This situation disproportionately affects low-income workers and women.

Subheading 2: Interactive Elements on Retirement Planning

Introduction: Retirement planning isn't a static process; it requires continuous adjustment and adaptation. Utilizing interactive tools and resources can significantly improve outcomes.

Facets: Online retirement calculators, financial advisors, and government resources offer personalized guidance. However, navigating this information can be challenging, highlighting the need for improved financial literacy programs. Understanding investment options and risk tolerance is crucial for effective planning.

Summary: Interactive elements play a vital role in empowering individuals to take control of their retirement futures. However, accessibility and usability remain significant obstacles.

Subheading 3: Advanced Insights on Retirement Security

Introduction: Beyond individual planning, systemic changes are needed to address the retirement crisis. This requires a multi-faceted approach.

Further Analysis: Policies promoting employer-sponsored retirement plans, raising the minimum wage, and expanding access to affordable healthcare are essential. Furthermore, exploring innovative solutions, such as reverse mortgages or annuities, can provide crucial supplemental income.

Closing: Securing retirement for aging American workers requires a collaborative effort from individuals, employers, and policymakers. A proactive and comprehensive approach is vital to mitigate the looming crisis.

5. People Also Ask (NLP-Friendly Answers):

Q1: What is the average retirement savings for Americans? A: The average retirement savings varies greatly depending on age and income, but many Americans have significantly less saved than needed for a comfortable retirement.

Q2: Why is retirement planning so important? A: Retirement planning ensures financial security and independence in later life, reducing reliance on social security and preventing financial hardship.

Q3: How can I improve my retirement savings? A: Contribute regularly to employer-sponsored plans, explore individual retirement accounts (IRAs), and prioritize saving consistently.

Q4: What are the biggest challenges to retirement planning? A: Insufficient income, high healthcare costs, and longevity are among the biggest challenges faced by Americans planning for retirement.

Q5: How can I get help with retirement planning? A: Seek guidance from financial advisors, utilize online resources and calculators, and attend educational workshops.

6. Practical Tips for Retirement Planning:

Introduction: Taking proactive steps can significantly improve your retirement outlook. Here are some actionable tips:

Tips:

- Start saving early.

- Maximize employer-sponsored retirement plans.

- Diversify your investments.

- Regularly review and adjust your retirement plan.

- Understand healthcare costs and plan accordingly.

- Explore additional income streams.

- Seek professional financial advice.

- Stay informed about retirement policies and regulations.

Summary: These tips provide a framework for building a secure retirement. Remember, consistency and planning are key.

Transition: By addressing these challenges proactively, we can move toward a future where retirement is a source of comfort and security, not fear and uncertainty.

7. Summary:

The retirement crisis facing aging American workers demands immediate attention. A multifaceted approach involving individual responsibility, employer support, and policy changes is crucial to secure a financially stable retirement for all.

8. Call to Action:

Ready to take control of your retirement future? Explore our resources and start planning today!