Trade War Deepens: Central Banks Eye Rate Cuts

Editor’s Note: Concerns over a deepening trade war have intensified, leading central banks globally to consider interest rate cuts. This article analyzes the situation and its potential impact.

Why This Topic Matters

The escalating trade tensions between major global economies are creating significant uncertainty in the financial markets. This uncertainty is dampening economic growth and fueling fears of a global recession. Central banks, the institutions responsible for maintaining price stability and economic growth, are now responding by considering monetary policy adjustments, primarily interest rate cuts. This is a crucial development with far-reaching implications for businesses, investors, and consumers worldwide. We will explore the current state of the trade war, the reasons behind the potential rate cuts, and the likely consequences of this policy shift. Key aspects we'll cover include the impact on inflation, currency exchange rates, and global investment.

Key Takeaways

| Impact Area | Potential Outcome | Significance |

|---|---|---|

| Global Economic Growth | Slowdown or Recession | Major impact on employment and consumer confidence |

| Inflation | Potential deflation or disinflation | Could lead to further monetary easing |

| Currency Exchange Rates | Volatility and potential depreciation of affected currencies | Impacts international trade and investment flows |

| Investment | Reduced investment due to uncertainty | Hinders long-term economic growth and development |

1. Trade War Deepens: A Global Economic Slowdown Looms

Introduction: The ongoing trade disputes, particularly between the US and China, have significantly escalated in recent months. Imposed tariffs and retaliatory measures are disrupting global supply chains, increasing prices for consumers, and stifling business investment. This uncertainty has created a climate of fear among businesses and investors, leading to decreased spending and economic contraction in various sectors.

Key Aspects: The imposition of tariffs, trade restrictions, and the resulting uncertainty are the primary drivers of the current economic slowdown. Key sectors like manufacturing and technology are particularly vulnerable, leading to job losses and reduced production. The impact extends beyond these sectors to consumer spending and broader economic confidence.

Detailed Analysis: Data from various sources, including IMF forecasts and reports from major financial institutions, suggest a downward trend in global economic growth. The analysis reveals a correlation between the escalating trade tensions and this slowdown. Examples of specific industries affected and the magnitude of the impact are crucial components of this analysis. This section will utilize charts and graphs to visually represent this data and its impact.

2. Interactive Elements on Central Bank Response

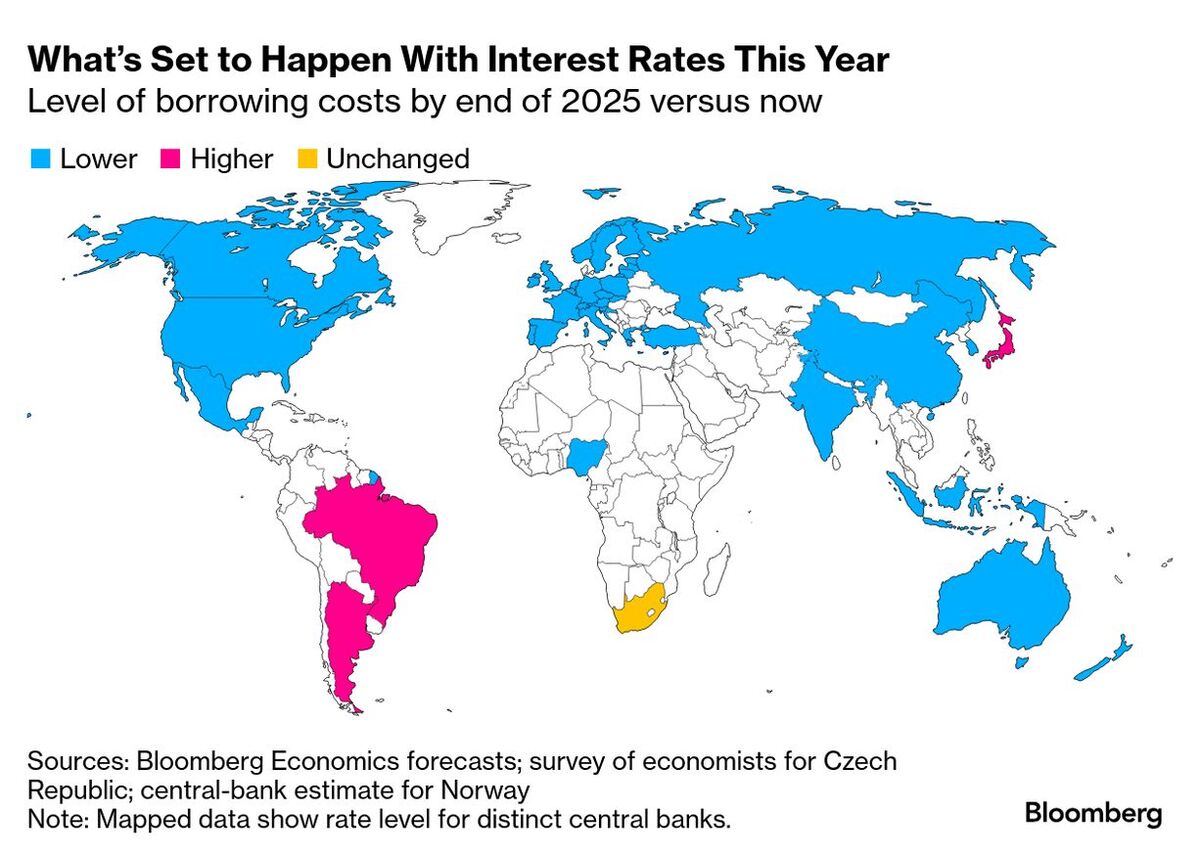

Introduction: Central banks are closely monitoring the situation and are prepared to intervene with monetary policy tools to mitigate the negative effects of the trade war. The primary tool under consideration is a reduction in interest rates.

Facets: Lowering interest rates aims to stimulate borrowing and investment, boosting economic activity. However, there are potential downsides. Rate cuts could exacerbate inflation if not carefully managed, and may not be effective if businesses are hesitant to invest due to the underlying uncertainty caused by the trade war. Furthermore, a global rate cut race could destabilize currency markets and cause unforeseen financial consequences.

Summary: The decision to cut rates is a delicate balancing act for central banks. The effectiveness of this measure depends heavily on the depth and duration of the trade war's impact, as well as the overall health of each individual economy. This requires careful consideration of economic indicators and risks associated with loose monetary policy.

3. Advanced Insights on the Long-Term Implications

Introduction: The long-term consequences of the trade war and the resultant monetary policy adjustments are complex and uncertain. Understanding these potential implications requires a deeper dive into the interconnectedness of global economies.

Further Analysis: This section will explore potential scenarios, examining different responses from central banks and the resulting impact on global financial markets. Expert opinions from economists and financial analysts will be included to provide a balanced and informed perspective. The discussion will delve into the potential for a prolonged period of low growth, the impact on technological innovation, and the potential for a realignment of global trade relationships.

Closing: The trade war and the potential for widespread rate cuts represent a significant challenge to the global economy. The long-term implications are far-reaching and require ongoing monitoring and proactive adaptation from businesses and policymakers alike.

People Also Ask (NLP-Friendly Answers)

Q1: What is a trade war? A: A trade war is a situation where countries impose tariffs, quotas, and other trade barriers on each other's goods and services, leading to reduced trade and economic conflict.

Q2: Why is the trade war important? A: It significantly impacts global economic growth, investment, and consumer prices, potentially leading to a global recession.

Q3: How can the trade war benefit me? A: It's unlikely to directly benefit individuals. However, potential benefits could arise from government interventions aimed at supporting specific industries or through adjustments in consumer behavior.

Q4: What are the main challenges with the trade war? A: Uncertainty, reduced trade, higher prices for consumers, decreased investment, and potential global recession.

Q5: How to prepare for the trade war's effects? A: Stay informed about economic developments, diversify investments, consider supply chain resilience, and be prepared for potential price increases.

Practical Tips for Navigating Economic Uncertainty

Introduction: Individuals and businesses can take proactive steps to mitigate the impact of the trade war and economic uncertainty.

Tips:

- Diversify your investments.

- Monitor economic indicators closely.

- Review and adjust your budget.

- Explore new business opportunities.

- Strengthen your supply chain.

- Focus on cost efficiency.

- Communicate effectively with stakeholders.

- Develop contingency plans.

Summary: Taking proactive steps to prepare for economic uncertainty can significantly reduce its impact on your financial well-being and business stability.

Transition: The future remains uncertain, but by understanding the dynamics of the trade war and adopting a proactive approach, we can better navigate the challenges ahead.

Summary

The deepening trade war is a major concern for global economic stability. Central banks are considering rate cuts as a response, but the effectiveness of this measure is uncertain. The long-term implications are complex and require careful monitoring and adaptation from both businesses and policymakers.

Call to Action

Ready to dive deeper? Subscribe for more insights on global economic trends and financial markets.