Trump Tariffs: Rate Cuts Loom Amid Trade War

Editor’s Note: The ongoing impact of Trump-era tariffs continues to dominate economic headlines. This article explores the potential for interest rate cuts as a response to the trade war's lingering effects.

Introduction: The lingering shadow of the Trump administration's tariffs continues to cast a pall over the global economy. While the immediate impacts are fading, economists are increasingly concerned about the secondary effects, particularly on inflation and growth. As a result, speculation mounts that central banks may be forced to cut interest rates to mitigate the economic slowdown potentially caused by these persistent trade barriers. This article examines the complex interplay between Trump's tariffs, inflation, economic growth, and the likelihood of impending interest rate adjustments.

Why This Topic Matters: The Trump tariffs, implemented between 2018 and 2020, significantly impacted global trade flows and supply chains. While some tariffs have been removed or modified, their lasting impact on inflation, investment, and consumer prices remains a key concern for policymakers worldwide. Understanding the potential for rate cuts in response is crucial for businesses, investors, and consumers navigating the current economic landscape. The ripple effect of these trade policies extends far beyond immediate trade disputes, affecting long-term economic stability and global financial markets.

Key Takeaways:

| Impact | Explanation | Implication |

|---|---|---|

| Tariff-Induced Inflation | Higher import costs lead to increased prices for consumers and businesses. | Central banks may cut rates to combat inflation's negative impact on growth. |

| Reduced Economic Growth | Trade uncertainty and higher prices stifle investment and consumer spending. | Rate cuts stimulate borrowing and investment, boosting economic activity. |

| Supply Chain Disruptions | Tariffs complicate global supply chains, leading to shortages and higher costs. | Rate cuts may offset the negative impacts of these disruptions. |

| Global Economic Uncertainty | The lingering effects of the trade war create uncertainty for businesses. | Rate cuts aim to bolster investor confidence and mitigate risk aversion. |

1. Trump Tariffs: A Lingering Economic Challenge

Introduction: The Trump administration's tariffs, initially aimed at leveling the playing field with China and other trading partners, had a far-reaching impact. While some tariffs were reversed or modified, many remain in place, creating a persistent drag on economic growth.

Key Aspects: The tariffs increased costs for businesses and consumers, impacting everything from manufacturing to retail. This led to inflationary pressures and uncertainty, impacting investment decisions and hindering long-term economic planning. The disruptions to global supply chains also resulted in shortages and increased costs, further fueling inflationary pressures.

Detailed Analysis: Empirical studies have shown a correlation between the implementation of tariffs and a slowdown in economic growth, particularly in sectors heavily reliant on imported goods. This slowdown is further amplified by the uncertainty surrounding future trade policies, prompting businesses to delay investment decisions and consumers to curb spending. The resulting inflationary pressures erode consumer purchasing power and contribute to a broader economic slowdown.

2. Interactive Elements on Tariff Impacts

Introduction: The impacts of Trump's tariffs aren't static; they're dynamic and interconnected, with feedback loops influencing various economic indicators.

Facets: Key elements include the interplay between inflation and interest rates, the impact on specific industries (e.g., agriculture, manufacturing), and the responses of different countries to these tariffs. Risks include stagflation (a combination of slow economic growth and high inflation), while challenges include managing inflation without triggering excessive currency devaluation. Rewards, however unlikely in the short term, include the potential for reshoring of production and increased domestic manufacturing.

Summary: The interactive nature of these impacts underscores the complexity facing central banks. Simple solutions are unlikely, and delicate balancing acts are required to mitigate the negative effects while avoiding unintended consequences.

3. Advanced Insights on Rate Cut Predictions

Introduction: Predicting central bank actions requires a deep dive into macroeconomic models and an understanding of policymaker's priorities.

Further Analysis: Leading economists are divided on the likelihood and timing of rate cuts. Some argue that inflation is the primary concern, necessitating rate hikes despite the economic slowdown. Others contend that supporting economic growth and preventing a deeper recession outweigh the risks of higher inflation, making rate cuts more probable. Expert opinions vary widely, reflecting the uncertainty surrounding future economic performance.

Closing: The decision to cut rates is a delicate balance between combating inflation and stimulating economic growth. The ongoing effects of the trade war make this decision even more challenging, demanding a careful evaluation of numerous interconnected factors.

People Also Ask (NLP-Friendly Answers):

Q1: What is the impact of Trump tariffs? A: Trump tariffs increased import costs, leading to higher prices, inflation, slower economic growth, and supply chain disruptions.

Q2: Why are interest rate cuts being considered? A: Rate cuts are considered to combat inflation caused by tariffs, stimulate economic growth, and offset the negative impact on investment and consumer spending.

Q3: How will interest rate cuts benefit consumers? A: Rate cuts might lead to lower borrowing costs for mortgages, loans, and credit cards, stimulating consumer spending and potentially increasing investment.

Q4: What are the risks of interest rate cuts? A: Rate cuts could exacerbate inflation if not carefully managed, potentially leading to currency devaluation and further economic instability.

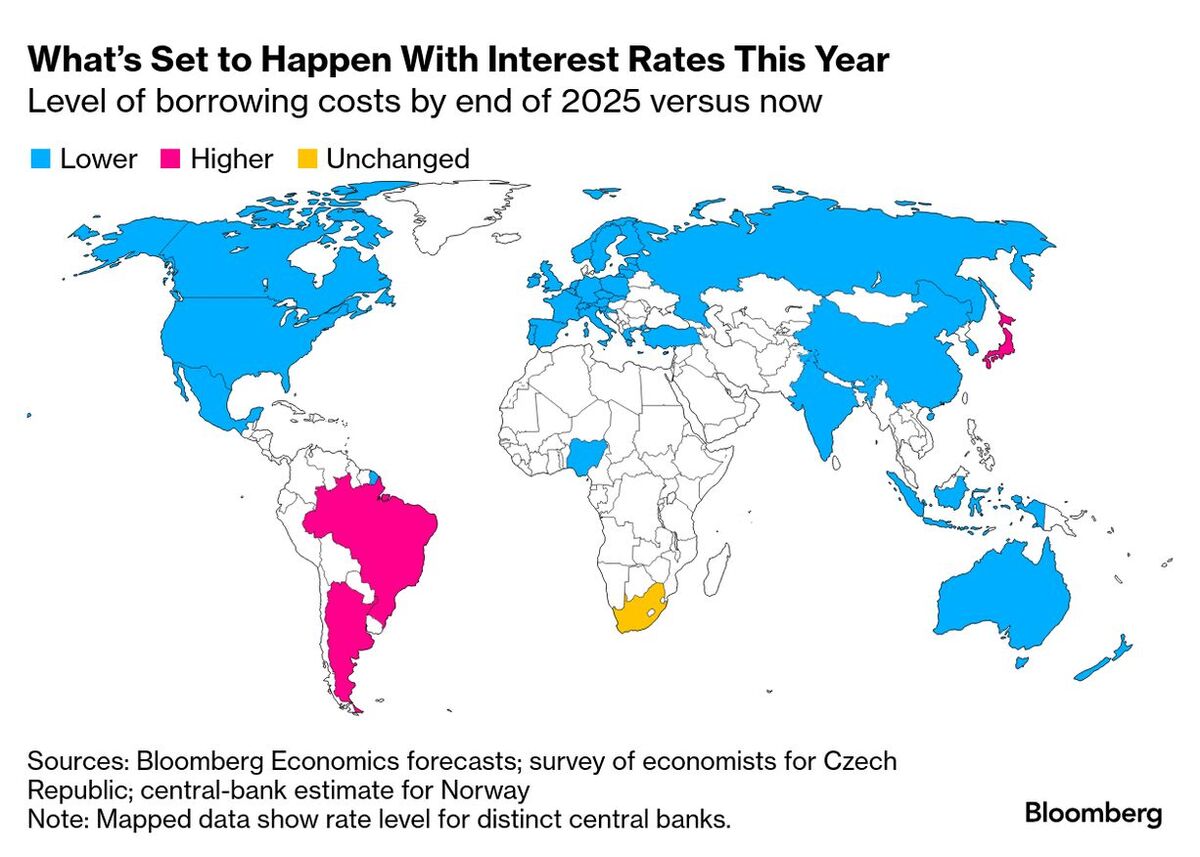

Q5: How are central banks responding to the situation? A: Central banks are closely monitoring economic indicators and inflation levels to determine the appropriate monetary policy response, which may include rate cuts or other measures.

Practical Tips for Navigating Tariff Uncertainty:

Introduction: While you can't control trade policy, you can adapt your business and financial strategies to mitigate the impact of tariff uncertainty.

Tips:

- Diversify your supply chains.

- Monitor inflation closely.

- Hedge against currency fluctuations.

- Explore cost-cutting measures.

- Develop contingency plans for trade disruptions.

- Stay informed about trade policy changes.

- Seek expert financial advice.

Summary: Proactive planning and adaptation can significantly reduce the negative impacts of lingering trade uncertainty.

Transition: The continuing impact of these tariffs calls for continued vigilance and adaptability in both the public and private sectors.

Summary: The lingering effects of Trump's tariffs pose a significant economic challenge. The possibility of interest rate cuts highlights the complex interplay between trade policy, inflation, and economic growth. Careful consideration of these intertwined factors is crucial for navigating the current economic climate.

Call to Action: Ready to dive deeper? Subscribe for more insights on the evolving economic landscape shaped by trade policies!