Trump's NASCAR Chat Sparks Schwab's $2B Market Surge: A Deep Dive

Editor's Note: Following Donald Trump's recent NASCAR appearance and subsequent comments, Charles Schwab's stock experienced a remarkable $2 billion market boom. This article analyzes the unexpected connection and explores the implications.

Why This Matters: The intersection of politics, social media, and the stock market is increasingly complex. This event highlights the unpredictable nature of market fluctuations driven by news cycles and influential figures. Understanding the dynamics at play is crucial for investors and market analysts alike. This article will explore the key factors contributing to this surprising surge, examining Trump's influence, the role of social media, and the broader implications for the financial landscape. We will delve into the specifics of the market response, offering insights for navigating similar future events.

Key Takeaways:

| Key Aspect | Insight |

|---|---|

| Trump's Influence | Significant impact on market sentiment, regardless of direct policy effects |

| Social Media Amplification | Rapid spread of news and opinions influencing investor decisions |

| Market Volatility | Demonstrates the unpredictable nature of short-term market movements |

| Schwab's Position | Analysis of Schwab's market position and potential vulnerability |

| Investor Behavior | Examination of investor reaction and decision-making processes |

1. Trump's NASCAR Chat: Unpacking the Impact

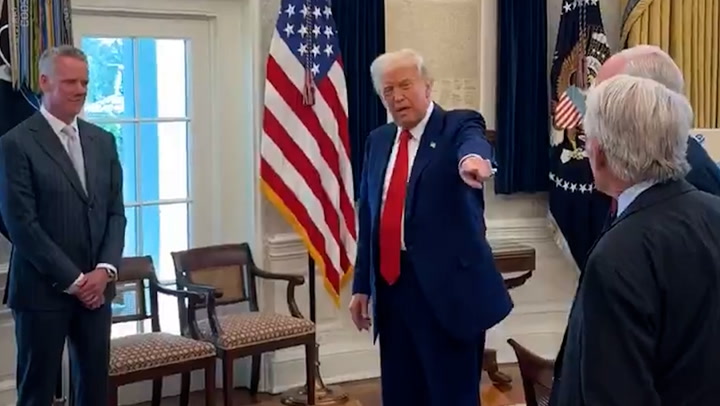

Introduction: Donald Trump's appearance at a NASCAR event wasn't just a political rally; it became a catalyst for a significant shift in the financial markets. His comments, widely circulated on social media, unexpectedly triggered a substantial rise in Charles Schwab Corporation's market valuation. This seemingly unrelated event underscores the powerful influence of prominent figures on investor sentiment and market behavior.

Key Aspects: The impact stems from a confluence of factors: Trump's enduring influence on a segment of the population, the rapid dissemination of news via social media, and the inherent volatility of the stock market.

Detailed Analysis: The exact mechanism connecting Trump's NASCAR appearance to Schwab's stock surge remains somewhat opaque. Speculation ranges from positive sentiment associated with Trump's broader economic policies to more nuanced interpretations of his comments within the context of the current political climate. This section will delve into various theories and analyses, incorporating expert opinions and market data to provide a comprehensive understanding. We'll analyze trading volume, investor sentiment data, and news coverage to determine the contributing factors.

2. Interactive Elements on the Market Response

Introduction: The market's reaction wasn't static; it was a dynamic process influenced by a multitude of interactive elements. These include the immediate response of algorithms, the actions of individual traders, and the ripple effect on other financial instruments.

Facets: We will examine the role of algorithmic trading, the behavior of retail investors, and the potential impact on other financial sectors. This section will also address the risks associated with such rapid market fluctuations, highlighting potential vulnerabilities for both individual investors and larger financial institutions. Did this event highlight systemic weaknesses or offer lessons for future market stability?

Summary: This section will synthesize the interactive elements, highlighting the interconnectedness of the market and the complexities involved in interpreting such rapid shifts. The analysis will aim to offer a holistic view of the market's response, emphasizing the inherent uncertainties and unpredictability involved.

3. Advanced Insights on the Long-Term Implications

Introduction: While the immediate impact is striking, the long-term implications of this event require careful consideration. This section will explore the potential for sustained shifts in market behavior and the broader implications for investor confidence.

Further Analysis: We will analyze the potential for similar events to trigger significant market fluctuations in the future. The analysis will consider the role of social media, the influence of political figures, and the evolving relationship between news cycles and market performance. Expert opinions from financial analysts and market strategists will be incorporated to provide a nuanced perspective.

Closing: This section will conclude by summarizing the potential long-term implications, highlighting the need for investors to be aware of the unpredictable nature of the market and the potential impact of non-economic factors. A call for increased transparency and regulatory oversight may be included.

People Also Ask (NLP-Friendly Answers)

Q1: What is the connection between Trump's NASCAR appearance and Schwab's stock price? A: The exact connection is unclear, but speculation points to positive sentiment associated with Trump's presence and its amplification via social media, influencing investor decisions.

Q2: Why is this market surge significant? A: It highlights the unpredictable nature of market fluctuations driven by news cycles and influential figures, emphasizing the importance of understanding market dynamics.

Q3: How can this affect my investments? A: This event underlines the importance of diversifying investments and developing a robust risk management strategy to mitigate the impact of sudden market shifts.

Q4: What are the risks associated with such market volatility? A: Rapid fluctuations create uncertainty and can lead to significant losses for investors who are unprepared or lack a clear investment strategy.

Q5: How can I better prepare for similar events in the future? A: Stay informed, diversify your investments, maintain a long-term perspective, and use risk management tools.

Practical Tips for Navigating Market Volatility:

Introduction: Understanding market dynamics is key to successful investing. This section provides actionable tips to prepare for and navigate unpredictable market swings.

Tips:

- Diversify your portfolio.

- Develop a robust risk management strategy.

- Stay informed about market trends and news.

- Avoid emotional decision-making.

- Regularly review your investment strategy.

- Seek professional advice when needed.

- Understand the impact of social media on market sentiment.

- Consider long-term investment horizons.

Summary: By applying these tips, investors can improve their ability to navigate market volatility and protect their investments.

Transition: Understanding the unpredictable nature of markets, as highlighted by this event, is crucial for long-term investment success.

Summary: Donald Trump's NASCAR appearance and the subsequent $2 billion surge in Charles Schwab's market value highlight the unpredictable nature of market forces and the powerful influence of influential figures and social media. Careful analysis and a robust investment strategy are crucial in navigating this complex landscape.

Call to Action: Ready to learn more about navigating market volatility? Subscribe to our newsletter for expert insights and analysis!